Neo Bank: The Future of Banking

- Pratik S

- Sep 20, 2021

- 5 min read

As the name suggests is a whole new form of Bank. It is a digital-only bank without any physical branch available. These banks provide services ranging from simple payments solution to saving account, Payment management for businesses, International Payments option, Financial advisory, and other such services to individual consumer as well as Businesses.

Neo Bank does not have Bank License but to get a way around this restriction these banks tied up with other traditional banks for providing services that are license only. Neo banks are created to bridge the gap that traditional bank creates in terms of Long Processing time, the hassle of going to physical branch for Account opening and closing, higher service cost and other such issues by bringing the whole operation online.

How Neo Bank Work?

Neo banks are 100% online app-based Banks this sole feature of it saves then huge costs of having a physical branch and these cost-savings are transferred to consumers in terms of Lower processing fees, Higher Interest rates, lower transaction charges, round the clock customer support, and other such benefits.

Neo bank is built on Application Programming Interface (API), which is a computer-based programming that allows one software to communicate with the other in order to provide services. These banks are Banking as a Service(BaaS) provider. Fundamentally what Bank does is they allow these neo bank a limited and secured access to their core banking system performing banking operations it includes transactions, balance query and other such functions. By tying up with traditional banks the Neo Banks provide licensed Banking services with help of API integration.

Process:

Traditional banks open its core banking system for Neo Bank.

Neo Banks integrates the bank APIs to establish a connection Traditional bank’s core banking system.

Neo banks makes a request (API calls) to fetch the required data from traditional bank’s servers or execute functions.

Another aspect of Neo Bank is the use of AI and ML which makes data-based decision-making simple and this helps Neo Banks in providing customer-centric service. It is done by analysing how a consumer behaves in the Neo Banking environment and can suggest consumer with tailor-made financial services.

This Customer-Centric nature of Neo Bank helps them provide a much better user experience than the traditional banks. Tailor-made services include expense tracking for the customer, Budgeting, for businesses instant refunds to credit cards, and other such services.

Are these banks Legal?

According to the Reserve Bank of India (RBI) 2014 guidelines, It does not recognize payment banks or wallet under the term ‘banking’ in virtual and branchless banks. Thus, RBI is not issuing a separate virtual banking license to these neo banks. So in India for having bank license, it is mandatory to have a Brick-and-Mortar branch. Now ‘No Physical Branch’ is the concept on which Neo Banks are primarily based. Also, regulation of fully online or virtual banks is difficult. Hence currently as of 2021, the Neo Bank does not have a Bank license. But this does not stop them from growing rapidly. Neo Banks came up with the idea of outsourcing their banking operation with the traditional banks (who definitely has Bank license).

How they differ from others?

In India there are many mobile applications that provide payment solution and other services like Phone Pe, Google Pay, Paytm which provide 24×7 payment facility, on the other hand Neo bank also provide similar payment service but at the same time it provides much more like AI enables Investment suggestion and within few clicks that investment can also be done and other such services makes them stand apart from the present wallets.

Does India have Neo Banks?

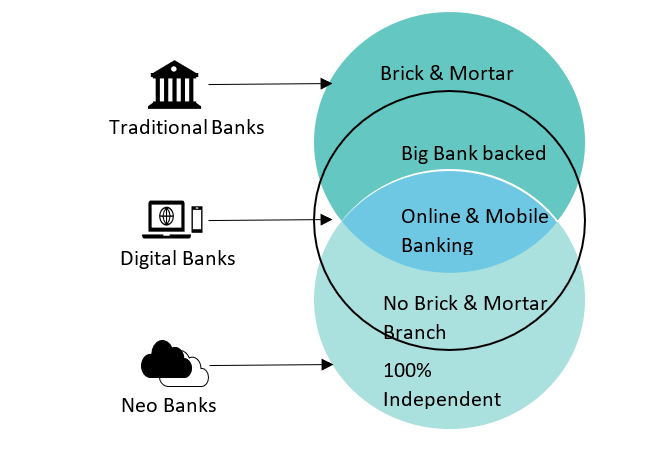

Yes, India is having an increase in the number of Neo Bank. A point must be noted that Neo banks must not be confused with Digi-banks that are offered by the traditional banks like Kotak Mahindra Bank’s ‘Kotak 811’ , ‘YONO’ by State Bank of India these are their digital offering and cannot be termed as a Neo Bank.

Some of the major players are -

RazorpayX: Launched in November 2018, it is one of the leading Neo Bank serving 10,000+ businesses providing services such as Payroll processing, Automated refunds to credit cards, UPI ID, bank account, and even Cash on delivery (CoD) for E-commerce business on subscription basis. Payment service to businesses (mostly SMEs).

Open: Started in May 2017, partnered with ICICI Bank, Yes Bank, Kotak Mahindra Bank. Provides services to SMEs and Startups with Business bank account, Payment Collection, automated accounting, expense management, and other such services.

Niyo: Started in 2015, provides services with various products designed for Individual consumers as well as businesses. Products include NiyoX, Niyo Global, Niyo Money, Niyo Bharat.

InstantPay: Provides services to Individual and Businesses, it offers subscription-based plans. Provides services such as Payment collection, loans, business accounts, Cashback, and gift cards, etc.

Future of Neo Bank India

Neo banks provides easy money transfer, fast payment and collection method, various investment schemes and other such benefits and it is providing a very cost saving platform for Small, medium enterprises and these banks are also initially targeting these SMEs as their prime customer base.

If we take a global outlook then Neo Banks are fast disrupting the Fintech space and are expected to have a size of $ 400 Billion by 2026. India’s absorption rate for the fintech and RoI in fintech startup is the highest. If we try to look into the future the Neo Banks success depends on level of Customer Awareness, cyber security, Protection form cyber-crime and customer experience and also most important the regulatory environment. Looking ahead in near future the hybrid model of traditional and digital banking is the sweet spot for India.

Advantages:

Easy account opening and closing: Online nature of banking enables hassle-free account opening and closing.

Cost-saving: Without the expense of a physical branches and huge staff enable banks to provide low processing fees and high-interest rates.

High Interest rates: Neo banks pays a high interest on saving account as well as FD compared to traditional Banks

Rapid Processing: Neo banks allow consumers to skip many time-consuming processes by making operations online.

Seamless International Payments: With neo bank one debit card allows the consumer to transact internationally as well as domestically.

Disadvantage:

No Physical Branch: The aspect of not having a branch can be a drawback as many customers want to have a physical branch where they can get their complaint redressal instead of an online chatbot.

Less Regulated: These banks are not regulated which exposes them to various risks and does not allow them to offer full banking service.

Converged Consumer Base: It is more likely that Tech savvy person will be more interested in fully online banking services.

To learn more about valuations, financial modeling, pitch books and research report writing skill sets to answer the basic question of how to start investment banking career, checkout the Platinum Bundle offered by Wizenius, one of the best investment banking courses.

Contact Us (For Free Demo, discount offers etc.)

91-9372443303

talk2wizenius@gmail.com

Comments